EPF Claim Status 2024 can be checked by visiting the official website of the employee provident fund. Employee provident fund is a savings Scheme which is created by the government of India in order to protect and safeguard the rights of the employees that are working in private and government institutes. The employees are liable to give a percentage of their earnings to EPF so that they can save that particular earning over a period of their employment and that can help them to live their old age. The employees can get major information about their EPF claim Status by visiting the official website presented by the government of India. For EPF the minimal contribution from the employee point of view should be 12% and then the company also needs to contribute another 12% on the basis of the income of the candidates.

Purpose of the EPF Claim Status

The EPF claim status will help the employees to get major information about the details of their EPF claim. The employees will be able to get information about the Employees provident fund program by visiting the official website dedicated by the Indian government. The employees need to visit the official website and enter the UAN in order to get the major information about their EPF.

- Employees will be able to get at the total money that they have in their EPF account through the official portal and they can also check the details related to the payment of their EPF fund if they have recently left the job through the official portal.

- Employees can track the progress of their EPF claim and they can plan their finances accordingly so that they are not left hanging in the middle of the withdrawal procedure. There are certain parameters that you must meet before applying for EPF withdrawal.

Also Read: SBI HRMS Portal

Benefits of Using EPF Claim Status

- Employees will be able to check the status of their EPF claim and they will be able to avoid any delays through the development of the EPF claim status procedure.

- The employees will be able to get accurate information about their EPF claim and it will help the employees to get rid of any errors in the EPF withdrawal procedure.

- The employees will be able to get a proper view of the claim status because the official EPF claim status procedure is very transparent for the employees as well as for the employers.

- The employees will be able to save a lot of time through the development of the official portal created by the Indian government to check EPF claim status. The employees will be able to check the status from anywhere and anytime.

- The employees will be able to check the rules related to the EPF by visiting the official portal created by the Indian government.

Eligible to Submit an EPF Claim

There is specific eligibility that you require in order to successfully apply for your EPF. Check out the eligibility criteria from the pointers given below you can only apply for the EPF if you follow one of the three eligibility criteria:

- Eligibility for Post-Retirement: EPF account holders who are over the age of 55 and have Post-retirement Accounts are qualified to claim their entire EPF corpus. However, if an individual chooses early retirement, they may not be eligible to receive the full value of their account.

- Pre-Retirement Claims: Individuals who are 54 years old and intend to retire within a year may claim up to 90% of their EPF corpus before retirement.

- Unemployment Claims: If an EPF account holder is unemployed for more than a month, they may be eligible to receive up to 75% of their EPF corpus. However, when they begin new employment, they will be required to transfer 25% of the amount to their EPF account. If an individual has been unemployed for more than two months, they may claim their entire EPF corpus.

Also Read: ESIC Online Payment

Various Type Process to Check EPF Claim Status

There are a lot of ways through which you will be able to check the amount in your EPF and the employees can follow any of the procedures of their choice. You can check out the details given below in order to no more about the ways through which you will be able to check your EPF without any problem:

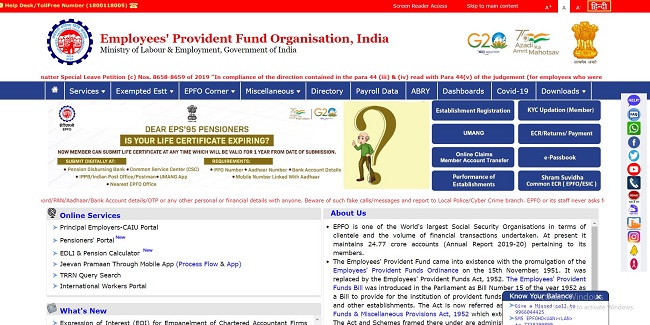

Check EPF Through the Official Website of EPFO

- Go to the official website of the Employees’ Provident Fund Organisation, India (EPFO).

- Click on the Services tab followed by the For Employees option.

- A new page will open on the screen.

- Click on the Know Your Claim Status link.

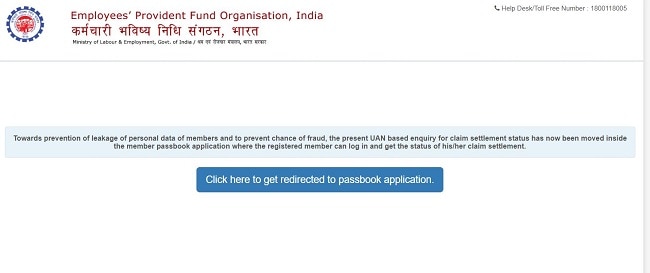

- A new page will open on the screen.

- Click on the Click here to get redirected to the passbook application link.

- The login page will open on the screen.

- Now, enter your Universal Account Number (UAN), password and the captcha code to get logged in to your registered account.

- Once you are successfully logged in, the dashboard of your account will open on the screen.

- Click on the View Claim Status option.

- Finally, the EPF Claim Status will open on your screen.

Procedure to Check EPF Claim Status through a Missed Call:

- Dial 011-22901406 from your registered mobile number.

- Ensure that your mobile number is linked to your UAN.

- Update your Permanent Account Number (PAN), Aadhar, and bank account details on the UAN portal.

- The call will automatically disconnect after two rings, and you will not be charged.

- An SMS with your claim status will be sent to your registered mobile number.

Procedure to Check EPF Claim Status through SMS:

- EPF claim status can be checked via SMS.

- The SMS must be sent from the employee’s registered mobile number linked to the UAN portal.

- The SMS should be sent to 7738299899 with the format “EPFOHO UAN LAN”.

- The language preference can be indicated by replacing “LAN” with the code for the preferred language.

- A table of language and code combinations supported by the SMS service is provided.

| Language | Code |

| English | ENG |

| Punjabi | PUN |

| Malayalam | MAL |

| Marathi | MAR |

| Telugu | TEL |

| Bengali | BEN |

| Hindi | HIN |

| Tamil | TAM |

| Kannada | KAN |

| Gujarati | GUJ |

Procedure to Check EPF Claim Status through the UMANG App:

- Open the App Store or Play Store on your smart device.

- Search for the UMANG app, download and install it on your device.

- Launch the UMANG app.

- There are two options to log in to your account:

- a. MPIN

- b. Login with OTP

- Enter your mobile number and select the preferred option.

- If you choose to log in with OTP, you will receive an OTP on your registered mobile number.

- Enter the OTP in the specified space and click on the Login button.

- You will be redirected to the EPFO portal main page.

- Select Employee-Centric Services.

- Click on the Track Claim option.

- A new page will open on the screen displaying your claim status.

Understanding the EPF Claim Status

It’s essential to keep track of the EPF claim status regularly to ensure that any issues are identified and resolved promptly. If an employee faces any difficulty or has any queries regarding the EPF claim status, they can contact the EPFO helpdesk or reach out to their employer for assistance. Here is a table explaining the various claim status messages for EPF and their meanings:

| Claim Status | Meaning | Action |

| Claim Settled | The EPF claim has been processed and the money has been transferred to the employee’s bank account | Check the bank account to ensure that the money has been credited |

| Claim Rejected | The EPF claim has been rejected due to incorrect information or insufficient documentation | Check the reason for rejection and rectify any errors in the information or provide additional documentation |

| Claim Under Process | The EPF claim is being processed by the EPFO | Wait for the EPFO to complete the processing of the claim |

| Claim Approved but Payment Pending | The EPF claim has been approved, but the payment is yet to be made | Wait for the payment to be processed by the EPFO |

| Claim Disbursed but Payment Failed | The EPF claim has been processed, but the payment has failed due to incorrect bank account details or other issues | Rectify any errors in the bank account details or contact the EPFO for further assistance |

| Claim Settled but Returned | The EPF claim has been processed, and the money has been transferred to the bank account, but the transaction has been reversed due to incorrect bank account details or other issues | Rectify any errors in the bank account details or contact the EPFO for further assistance |

Common Reasons for EPF Claim Rejection

EPF claims can get rejected due to a variety of reasons, including incomplete or incorrect information. Some of the common reasons for claim rejection are:

- Incorrect Bank Account Details: If the bank account information provided by the employee is incorrect, the claim may be rejected.

- Incorrect Personal Information: If the employee’s personal information, such as name, date of birth, or Aadhaar number, is incorrect, the claim may be rejected.

- Discrepancies in Documents: If there are discrepancies in the documents submitted along with the claim, such as incorrect PAN card details or incorrect Aadhaar card details, the claim may be rejected.

- Non-Availability of Aadhaar: As per the recent government directive, Aadhaar has been made mandatory for all EPF claims. In case an employee doesn’t have an Aadhaar card, the claim may get rejected.

- Incorrect Claim Form: If the employee submits an incorrect claim form or doesn’t follow the correct procedure for filing the claim, it may get rejected.

Avoid Claim Rejection

To avoid claim rejection, employees can follow these tips:

- Verify Information: Before submitting a claim, employees should verify that all the information they have provided, such as their bank account details, Aadhaar number, and other personal details, are correct.

- Update Information: Employees should keep their personal and bank account details up-to-date in their EPF account to avoid any discrepancies.

- Submit Correct Documents: Employees should ensure that they submit all the required documents and that the information provided in the documents is accurate.

- Follow Correct Procedure: Employees should follow the correct procedure for filing a claim and submit the claim form as per the guidelines mentioned on the EPFO website.

- Seek Help: If an employee is unsure about any aspect of the claim process, they should seek help from the EPFO office or the employer to avoid any errors or discrepancies.

In conclusion, checking the EPF claim status is important to ensure that employees receive their entitled funds. There are multiple methods to check the status, including online, through SMS or missed call, and via the UMANG app. It is crucial to ensure that all personal and bank account details are accurate to avoid claim rejection.

Contact Details

- EPF Toll-Free Helpline Number: 1800-118-005

- EPF Customer Service Email: [email protected]

Frequently Asked Questions (FAQs)

EPF Claim Status refers to the current status of your EPF withdrawal or transfer request. It tells you whether your claim is settled, rejected, or still under process.

You can check your EPF Claim Status through various methods, including online through the EPFO portal or UMANG app, via SMS, or by giving a missed call to a specific number.

Some common reasons for EPF claim rejection include incorrect bank account details, incorrect personal information, non-fulfilment of eligibility criteria, and mismatch of information in KYC documents.

If your EPF claim is rejected, you can rectify the errors in your KYC documents or bank account details and resubmit the claim. You can also contact the EPFO helpline for further assistance.

The time taken for EPF claim settlement varies depending on various factors such as the mode of claim, completeness of documents, and the accuracy of information. Generally, it takes around 10-15 days for online claims to get settled and 20-30 days for offline claims.