Kerala Vatsalya Nidhi Insurance Scheme-related information is available in this article. This scheme has been launched by the Kerala State Government for the girl child of the SC Category. We try to let you understand the scheme completely. You will be able to apply for the scheme after getting the complete details. In this article, we furnished information like eligibility criteria for the scheme, benefits of the scheme, what the scheme exactly is, and other related information along with a detailed application procedure.

About Kerala Vatsalya Nidhi Insurance Scheme

Under the Vatsalya Nidhi Insurance Scheme the government will provide life cover along with accidental cover to the girl child of the Scheduled Caste category. The scheme has been scheme implemented by the Scheduled Caste Development Department in collaboration with the LIC of India. The main aim of the government is the all-around development of Scheduled Caste girls. A Premium amount of the insurance coverage will be paid by the government. Interested applicants can grab the scheme benefits by applying online via vatsalyainsurance.kerala.gov.in.

Brief about the scheme

| Name of the scheme | Vatsalya Nidhi Insurance Scheme |

| Announced in | Kerala |

| Announced by | State government |

| Announced for | Girl child of SC category |

| Mode of application | Online |

Insurance benefits In Scheme

LIC will pays Rs. 3 lakhs to the insured girl on completion of 18 years of age. In addition, the girl, father, mother and brother/sister are entitled to benefits through LIC as added below:

| Accidental death | ||

| Income earner | Normaldeath | 2 Lakhs |

| Accidental death | 4 Lakhs | |

| Partial disability due to accident | 1 Lakh | |

| Accidental complete disability | 2 Lakhs | |

| Other parent | Normal death | 30000/- |

| Accidental death | 30000/- | |

| Child | Normal death | 3,00,000 / – to be credited to the child’s account and the balance of the fund deduction will be paid by LIC as insurance benefit. (This applies only after the age of 18) |

| Accidental death | ||

| Education benefits | ||

| Recipient | Study standard | Amount |

| Girl | 9,10,11,12 | 1200 per year |

| Brother or sister |

Eligibility OF Nidhi Insurance Scheme

- Applicant must belong to the schedule caste category

- Permanent residents of Kerala can apply for the scheme only

- The annual income of a family should not be more than 1 lakh

- Scheduled Caste girls must be born after 1.4, 2017

Premium details Of Nidhi Insurance Scheme

The department pays a total premium of Rs. 1,38,000 / – to LIC as given below:

| S.No. | Amount | Criteria |

| I | 39,000 | The girl must be registered in the scheme within 9 months of birth. The newborn should be vaccinated within the first 90 days. |

| II | 35,000 | The girl must be over 5 years old. Must be enrolled in primary school. In addition the remaining immunizations should be taken within a certain age. |

| III | 33,000 | Admission to Class 5 and 10 years of age must be attested by the Headmaster / Principal. |

| IV | 30,000 | Girls must have passed Class X and have attained the age of 15. Certificate of Passing Class X must be attested Certificate of inclusion in Vatsalya Nidhi Insurance |

Documents required For Apply

- Date of Birth Certificate,

- Vaccination Certificate from the Doctor,

- Parents Identity Card,

- Income Certificate,

- Proof of Address,

- Community Certificate,

- Photo Taken with Parents

Application procedure In Kerala Vatsalya Nidhi Insurance Scheme

- To apply you need to visit the official portal of Vathsalya Nidhi Insurance (VIMS)

- Enter the username and password, hit sign-in option

- Registration form will appear

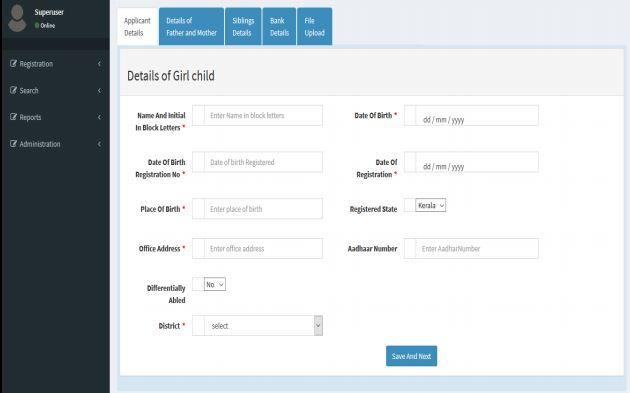

- The form is divided in five parts “Applicant Details, Details of Father and Mother, Siblings Details, Bank Details and File Upload”

- You need to provide the details step by step

- First step is applicant detail where you need to provide information such as Name, Date of Birth, Date of Birth, Registration Number, Place of Birth, Registered State, Office Address, Aadhar Number, Differently Abled Status, and District.

- Hit “save & next” and then second step form appears

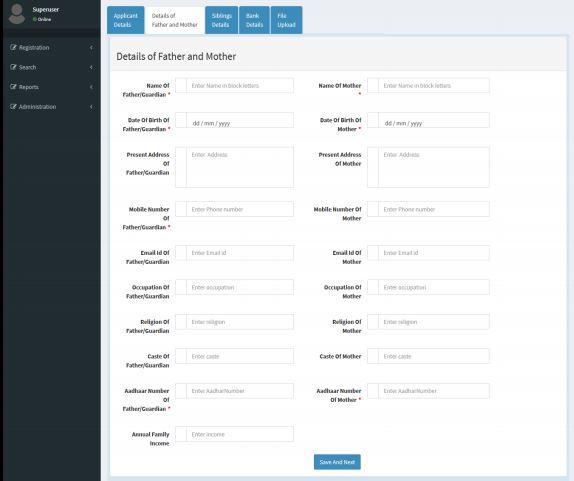

- Details of Father and Mother such as Name of the Father, Mother, Date of Birth of Father and Mother, Address for Communication of both parents, Mobile Number, Email ID, Occupation Details, Caste, Religion, Aadhar Number, and Family Income.

- Hit “save& next” and then the third step form appears

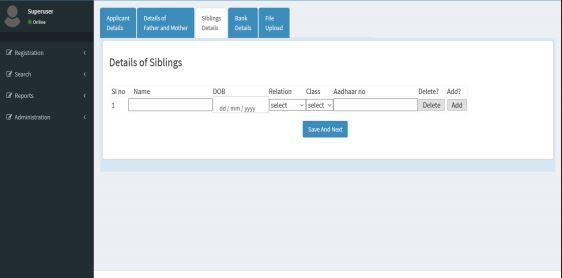

- Sibling details such as Name, Date of Birth, Relation, Class, Aadhar Number. If you have more siblings, you can add the other row to enter your siblings’ details.

- Hit “save & next” and then the fourth step form appears

- Enter bank details such as Account Holder Name, Account Name, Bank Name, Branch Name, and IFSC Code.

- Hit “save & next” and then the last step form appears

- Upload the documents listed above

- Hit save option for submission of application.