IGRS Delhi is created by the Indian government under the Department of Inspector-General of Registration and Stamps. The official portal is created so that the government can offer property registration services through the online portal. This online portal is very easy to use and anyone can use the portal in order to register their property online without having to visit different types of government offices. IGRS Delhi Portal will definitely save a lot of time for people who want to register their property online. The official website is created so that you can easily calculate the registration costs, and stamp duty, and perform background checks on the property, plans, maps, and land records. The website is created in order to make the property registration procedure more transparent and easy to undertake for the residents of Delhi. Check the major information about the portal given below.

Indian Stamp Act and Its Importance

The Indian Stamp Act, of 1899 is a legal act created by the Indian government in order to provide information about the Framework that will govern the payment of the stamp duty. People who are buying different properties in Delhi will have to make sure that they are paying the stamp duty presented by the government because then only they will have the legality over the products that they have bought in the City. People have to visit the official website and then they are liable to pay the fees according to the text that is presented by the Indian government.

- You will have to pay tax by the government on the transfer of property, such as sale deeds, agreements, and conveyance deeds.

- The amount of tax that you will have to pay depends upon the value of your property and the position of your properties so you have to make sure that you are calculating your tax by visiting the official website created by the organization.

Also Check: DDA Housing Scheme

What is Integrated Grievance Redressal System (IGRS) Delhi?

Integrated Grievance Redressal System (IGRS) Delhi is an online platform developed by the Delhi government. The platform will provide a safe space to the people so that they can easily pay their taxes and they can also apply for different types of complaints if they are facing any through the development of the official portal. People can fill out the application form available on the official website and then they can apply for their complaints to be heard by the Delhi government without having to visit different types of government offices in order to make a real complaint. The primary objective of IGRS Delhi is to enable citizens to register their complaints, track their status, and resolve their grievances promptly. This is a single platform where the people can easily pay their registration fees and also apply for different services.

IGRS Delhi Functions

- IGRS New Delhi offers multiple services and provisions for buying and registering real estate.

- DORIS Delhi website provides several services for registering a property, saving paperwork and time.

- Services include searching for registered documents and inspecting deed documents.

- Calculating stamp duty payable and writing the deed document are also available.

- Sub-registrar services such as inspection, NOC, certified copies, and more are provided.

- Grievance and complaint redressal is offered to address any concerns.

- Dues payable to local bodies can be accessed through the website.

- The website also lists prohibited properties in Delhi.

Also Check: Delhi E District Portal

Benefits of Using IGRS Delhi

The IGRS New Delhi web portal offers several advantages, including:

- Property Valuation: The portal provides a property value tool to assess properties in New Delhi based on location information.

- Real-Time Updates: The portal’s information is always up to date and accessible from anywhere, displaying the number of papers received, registered, and other property-related information.

- Property Search: The portal allows users to search for the registration status and other relevant information about their property. Documents for properties located in specific areas can also be downloaded.

- Simple Navigation: The portal is easy to use, even for new users. Quick links to key areas are available on the home page, enabling users to find the appropriate section for their queries easily.

Required Documents

The following documents are required in order to successfully register your property at the official website:

- Papers about the property, both original and copies.

- ID proofs (original) of the buyer, seller, and witnesses including Aadhaar numbers.

- 2 copies of passport-sized photographs of both the buyer and the seller.

- Hardcopy of the e-stamp paper showing the stamp duty amount.

- The receipt of e-registration fee was paid.

- Form 60 or copy of PAN card with self-attestation.

- NOC for property located on agricultural land

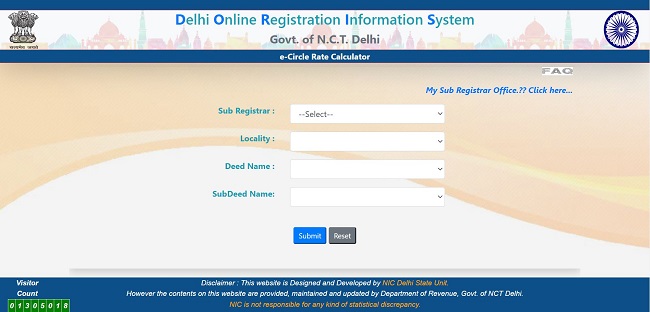

IGRS Delhi Stamp Duty Calculator

- Visit the IGRS website by clicking on the link given here

- Select the “e-valuation” option from the top menu.

- A new page will open where you have to select:

- Sub Registrar

- Locality

- Deed Name

- SubDeed Name

- Click on submit

- The rate will open on your screen.

Stamp Duty Charges and Other Verifications

When purchasing property in India, it is important to be aware of the registration fee and stamp duty rates. The registration fee is typically 1% of the property’s total sale price. However, it is essential to review all relevant documents carefully before proceeding with the purchase. Documents such as the mother deed, encumbrance certificate, property tax receipts, and building permit should be checked thoroughly. To assist with this process, both the DORIS Delhi website and registering officials can provide valuable guidance and information.

Property Mutation Under IGRS New Delhi

It is recommended that property owners pursue property mutation once they have completed the registration process with IGRS New Delhi. It is important to inform the relevant authorities whenever there is a change in ownership of a property. Failure to do so may result in municipal authorities imposing property tax on the new owner. Additionally, in order for the new owner to obtain legal water and electricity connections in their name, they must possess a mutation certificate. The Municipal Corporation of Delhi (MCD) website, mcdonline.nic.in, provides information about the mutation process, including the required forms. Form B is used for transferring property through inheritance, while Form A is used for other non-inheritance properties.

How to Register Property at IGRS Delhi?

First Step

- Visit the DORIS Delhi official website by clicking on the link given here

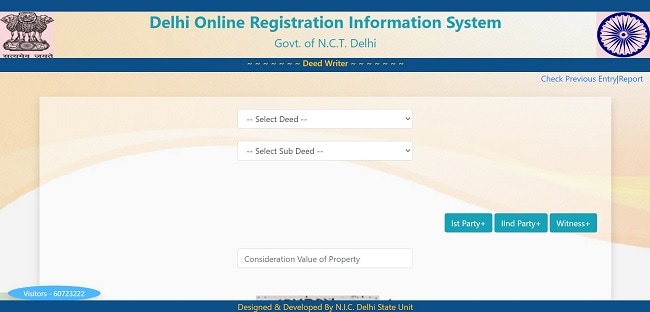

- Select the “Deed Writer” option from the top menu, and a new website will open where you can write your deed as per your requirements. You can choose the type of deed from the dropdown menu and provide details for the first party, second party, and witnesses.

- Use the e-valuation button on the DORIS Delhi website to determine the payable stamp duty. You will be directed to a new page where you need to select the sub-registrar from the dropdown menu and provide details for the locality, deed, and sub-deed.

- Purchase an electronic stamp paper with the value calculated in your evaluation calculator. You can purchase the stamp paper from the nearest Stock Holding Corporation of India office or their official website.

Second Step

- To make the payment for registration, go to the “Products and services” option on the official website, followed by “e-Stamp services” and “e-Registration.” Register yourself if it’s your first time, or log in with your secure login name and password if you have used the services before. Choose the product (payment of the registration fee) and download the receipt after making the payment.

- The final step is to visit the sub-office registrar’s office physically. Schedule an appointment online using the appointment management system for the Revenue Department available at https://srams.delhi.gov.in/. Enter the property address, location (including district), sub-office registrar’s address, and the reason for the appointment. Verify that the sub-office registrar’s is close to the location of the property.

Third Step

- Make sure you have all the necessary documents required for the appointment, and answer “Yes” when asked if you have all the required documents ready. Enter the e-stamp number from the downloaded receipt and then schedule the appointment with the SR office. An SMS will confirm the appointment details, including the day, time, and location.

- In case you miss the appointment, you can set up another appointment using a similar procedure. However, rescheduling is only allowed once, so make sure to attend the appointment at the scheduled time.

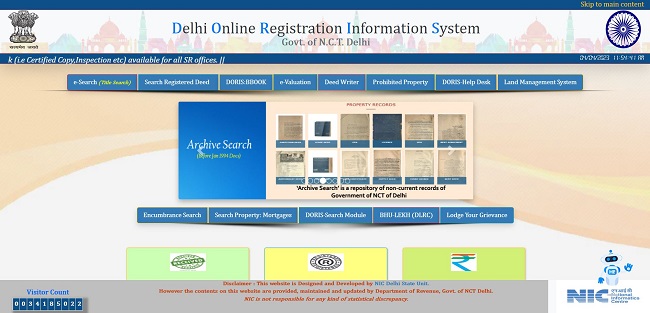

How to access and use DORIS portal?

If you want to access the official website then you can follow the simple steps given below:

- To access online registration facilities, visit the official website of DORIS Delhi.

- On the home page of IGRS New Delhi, you can find various options to assist you with property registration.

- Some of the options available on the website include e-Search, which allows you to search for registered deeds.

- You can also use the encumbrance search feature to look up prohibited property.

- The website offers a comprehensive set of tools to help you throughout the property registration process.

In conclusion, the Delhi Online Registration Information System (DORIS) portal of the IGRS New Delhi offers a streamlined and convenient way to register your property and calculate stamp duty fees. With its user-friendly interface, online tools for property valuation and stamp duty calculation, and easy appointment scheduling system, property registration has become simpler and more efficient.

Contact Details

- Revenue Department, Government of NCT of Delhi

IGRS Delhi 2023 FAQs

IGRS Delhi is an online portal for property registration and stamp duty calculation in Delhi. It is managed by the Revenue Department of the Government of NCT of Delhi.

To register your property through IGRS Delhi, visit the DORIS Delhi website and follow the steps outlined in the property registration procedures.

The stamp duty rate for property registration in Delhi is 4% for female buyers and 6% for male buyers.

You can use the e-valuation calculator on the DORIS Delhi website to calculate the stamp duty for your property registration in Delhi.

You can purchase electronic stamp paper from the Stock Holding Corporation of India or through their official website.